A paper describing circumstances wherein welfare is increased by suppressing information that generates excess volatility in the price of an asset or currency around its long run value

is available at: http://research.stlouisfed.org/wp/2010/2010-001.pdf . Apparently, the author, a Federal Reserve Bank vice president, doesn’t accept the notion of inequity aversion or behavioral economics in general. I hope that the Fed’s research products have little influence on the policies it chooses to promulgate.

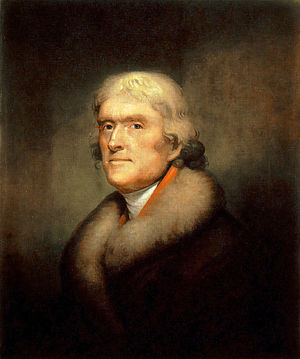

Although he was speaking of the free press, I’m pretty sure Thomas Jefferson wouldn’t mind substituting transparency in his quote,”The agitation it produces must be submitted to. It is necessary, to keep the waters pure.” (Letter from Jefferson to Lafayette, 1823).

Image via Wikipedia

Image via Wikipedia

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=79152897-cfd1-4909-bff0-cd8ada99a6fc)